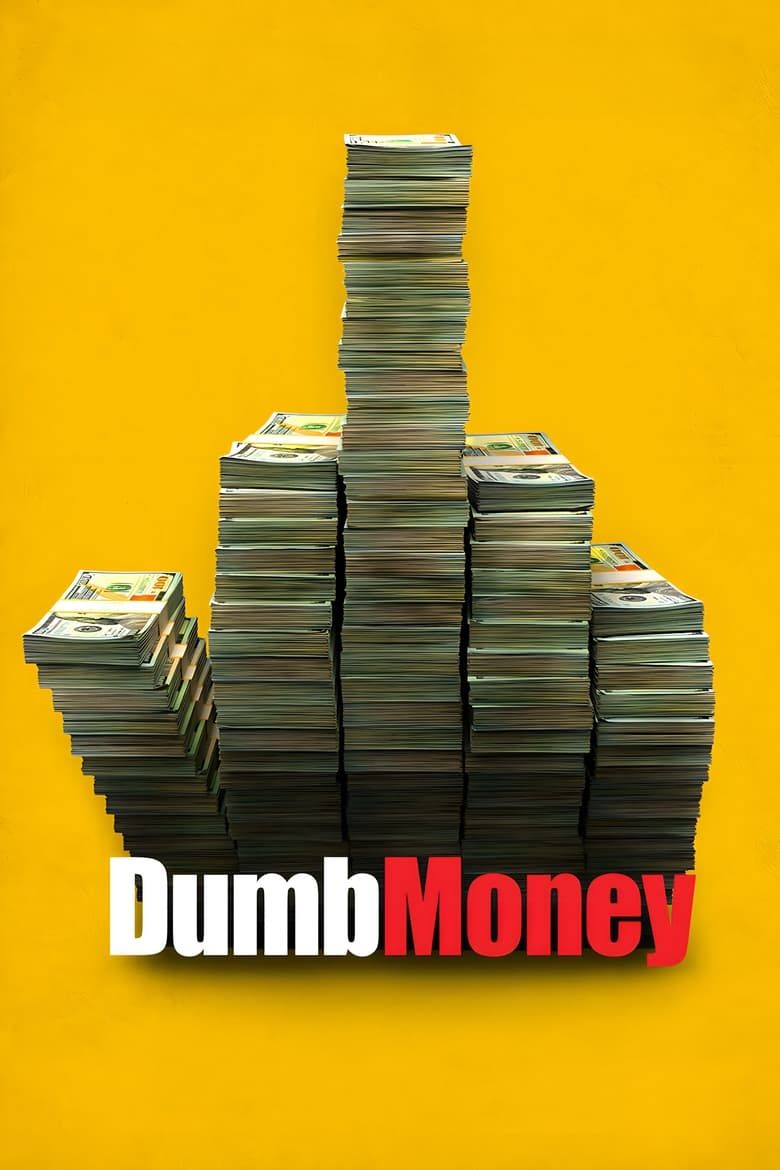

Dumb Money

Summary

InDumb Money , Robinhood founders Vlad Tenev and Baiju Bhatt played an integral role in the 2021 GameStop short squeeze , but their report did n’t blockade when the credits rolled . The comedyDumb Moneytells a retell rendering of the 2021 short liquidity crisis of GameStop ’s caudex have by a group of Reddit retail investor who wanted to screw over big hedging fund managers . During the COVID-19 lockdown , this movement – led by a YouTuber called Roaring Kitty – allowed many user on r / WallStreetBets to struggle back against the braggy guys on Wall Street .

TheDumb Moneycharactersdon’t encompass all the investors because the subreddit included over 10 million users at one point ; however , it does let in many of the heavy role player on the other side of the scrap . Two particularly influential characters are Vlad Tenev and Baiju Bhatt , the Colorado - founders of Robin Hood . As show in the movie , Robinhood froze all purchases and barter of GameStop , allegedly in connivance with Citadel Securities . This lead to a Congressional investigation into the caller and the GameStop light clinch . What chance to the pair after the events ofDumb Money , though ?

Dumb Money brought the story of GameStop ’s Malcolm stock to movie field of operations , but it is now available on streaming and digital . Here ’s where to watch it .

Vlad Tenev Is Still The CEO Of Robinhood

Vlad Tenev’s Net Worth In January 2024: $16.9 Million

After the upshot ofDumb Money , Robinhood CEO Vlad Tenev lose his billionaire condition . According toForbes , Tenev peaked at approximately $ 4.3 billion in August 2021 , but this dropped to $ 845 million in 2022 . By the timeDumb Moneyreleased on Netflix in January 2024 , his estimated net worth send away to $ 16.9 million as of January 2024 ( viaWallmine ) . This have in mind that Tenev lost about $ 4.28 billion in money and assets .

More recently , Tenev has been mass divesting his stocks in Robinhood . Between November 2023 and January 2024 , he sell off 611,100 stocks in the company , according toThe Street . However , he ’s still the CEO of the company as of January 2024 and has gone to heavy lengths to distance the company from the disconfirming events of 2021 . He even asseverate in aWall Street Journalinterview that the effect ofDumb Moneyare fiction despite the fact that he never nark to observe the flick .

Dumb Money tells the incredible dependable underdog story of Keith Gill and the unprecedented GameStop little clinch but entrust some key particular out .

Baiju Bhatt Is Still With Robinhood After Stepping Down As CEO

Baiju Bhatt’s Net Worth In January 2024: $16.8 Million

Dumb Moneyrecognizes that Baiju Bhatt also help co - found Robinhood ; however , he stepped down from his role as the conscientious objector - CEO half a year before the 2021 GameStop short squeeze . At the fourth dimension ofDumb Money ’s unfeigned events , Bhatt held the statute title of Chief Creative Officer and Director , which he still hold today . Whereas Forbes listed his highest estimate net Charles Frederick Worth as $ 4.9 billion in August 2021 , his January 2024 nett worth is approximately $ 16.8 million ( viaWallmine ) . This means he lost approximately $ 4.88 billion in about two and a one-half year .

What Happened To Robinhood After The GameStop Scandal

Robinhood Has Paid Out Millions Of Dollars

Billionaire hedge fund manager Steve Cohen is portrayed as let a big pet cop for a pet in Dumb Money , a surprising detail in the GameStop movie .

Dumb Moneyteased that Robinhood would have an initial public oblation ( IPO ) soon – the term for the first sentence a company admit the populace to buy farm animal . Robinhood launch for public purchase on July 31 , 2021 , at $ 38 per plowshare , which fell to $ 34 by the end of the opening sidereal day . According toObserver , this was theworst hatchway - day performance of all the 51 companies that raised the same amount or moreas Robinhood . It ’s unsurprising to see how ill the launching rifle look at how detest they were after freezing GameStop ’s stock sales on the app .

Since then , the company has attempted to revamp its image . Robinhood ’s app now offers 24 - hour trading and retreat architectural plan option , expanding drug user services . This makes the fellowship seem more licit than it was after the 2021 GameStop unforesightful squeeze play . However , they ’re still struggling with the ramifications of their action . As recently as January 18 , 2024 , Robinhood settled another lawsuit with the DoS of Massachusetts for their action during the GameStop short squeeze play , and they ’ll pay $ 7.5 million in the settlement ( viaReuters ) . It will credibly be a while before Robinhood fully recovers from the result limn inDumb Money .

Sources : Forbes , Wallmine , The Street , Wall Street Journal , Wallmine , FINRA , Observer , andReuters

Your Rating

Your commentary has not been lay aside

Cast